Many years ago, when I visited my son Craig at Stanford University his friend Bertram lured me into a game of darts in the student lounge. Our target was the typical small dartboard. Although I won the first game, Bertram won the next two. In fact, after my initial “beginner’s luck,” many of my darts bounced helplessly off the wall.

Many years ago, when I visited my son Craig at Stanford University his friend Bertram lured me into a game of darts in the student lounge. Our target was the typical small dartboard. Although I won the first game, Bertram won the next two. In fact, after my initial “beginner’s luck,” many of my darts bounced helplessly off the wall.

Any goal in life is a target. I want the job. I want to make the sale. I want to win the game. Often when the goal is especially important the target seems to shrink to a tiny dot, much like the apple resting upon the head of William Tell’s young son as he was forced by the Austrian governor to prove his prowess with a bow and arrow.

You can either approach archery the hard way, like William Tell, or the easy way. The hard way is to practice, practice, practice, taking greater and greater risks under more and more challenging conditions. Certainly practice and challenge are useful tools. But there is an easier way to hit your target:

Expand your target.

Instead of using a minuscule bull’s-eye, try aiming at a target as big as an IMAX screen. This technique produces even more bull’s-eyes than Bertram made when he won our second two games of darts.

The obvious question is, how can you expand your target? The answer is simple: make your goals more and more general.

Here’s an example. When I met Jerry he was thirty-one, divorced, and desperately seeking to meet a twenty-five year old woman, fall in love, get married, and have three children—boy, girl, boy. The woman had to be at least five feet six inches tall, never married, and successful in her career but willing to give it up and stay home with their children.

Jerry was aiming at a rather small target. As months became years, Jerry dated more than thirty different women. Most of them were tall, never married, and successful in their careers. None was willing to marry Jerry, have three children, and abandon her career to stay home with their as-yet-unborn children.

One day Jerry called me, very excited.

“I want you to meet Jan,” he said. “Can you and Daveen (my wife) have dinner with us Saturday night?”

I checked my calendar. “We’d love to.”

As we were driving home after a lively evening, Daveen was surprised.

“I thought that Jerry only dated women who were five feet six inches or taller,” she said. “Jan is shorter than I am. She couldn’t have been more than five foot two.”

“I think you’re right.”

“And there is no way in the world that woman is going to give up her $200,000-a-year TV production job to stay home with babies.”

“True. In fact she said that she wasn’t sure she wanted more than one child, two at most,” I added.

“What happened to Jerry’s checklist?” she asked.

“I don’t know. I’ll ask him.” The next day I called Jerry. “Daveen and I enjoyed our dinner with you and Jan.”

“Yeah, isn’t she terrific? I think we might get engaged.”

“That’s great, Jerry, but I thought you were looking for a taller woman who would stay home with your three unborn children . . .”

“That was two years ago,” he said. “Time has worn me down, thank goodness.”

“So you’re willing to settle?”

“No way. I’ve just expanded my horizons.”

“Jerry, you’re going to have to explain that one to me.”

“Sure. It’s true that I used to be very particular about who I dated. I carried around in my head a catalogue, like a spec sheet for a new car, and if a woman didn’t meet all the qualifications I wouldn’t even ask for her phone number. But it didn’t work.”

“Not enough candidates?”

“No. I met a number of great women, but I began to realize that my requirements were too restrictive. I mean, five foot six, five foot ten, five foot two—what difference does it really make?”

“None to me, but you’re in charge of your life.”

“Exactly. I learned that what I really wanted was someone who is fun to be with, a good companion, and someone who adores me.”

“Exactly. I learned that what I really wanted was someone who is fun to be with, a good companion, and someone who adores me.”

“Jan certainly seemed to meet those requirements.”

“You bet.” I could feel Jerry’s enthusiasm over the phone. “As I said, I just broadened my horizons.”

Expand your target. It works!

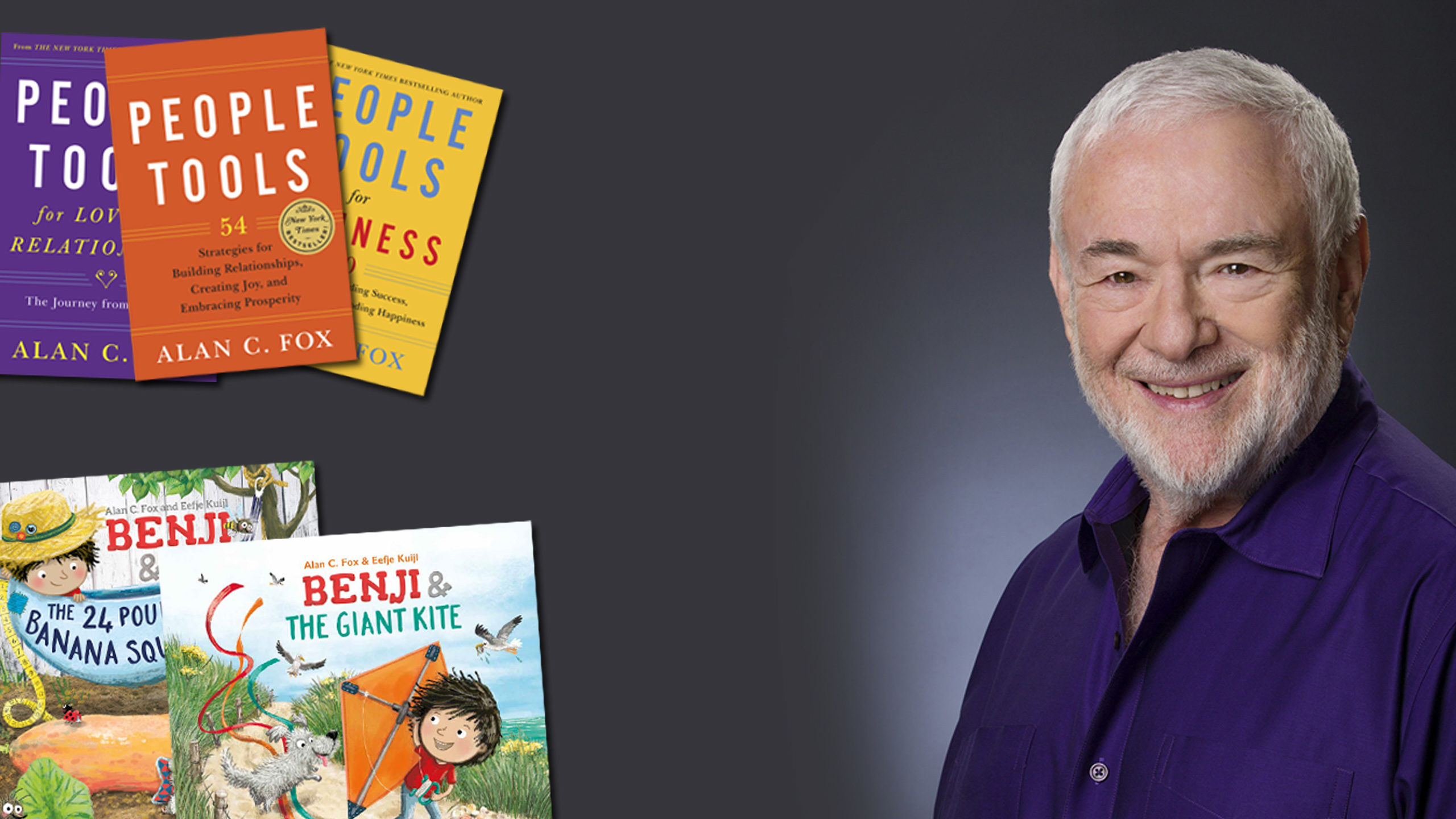

Alan