I’ve lived in Sherman Oaks for more than fifty years. My homes have, until now, always been located on steep hills. One was even on an unpaved cull de sac. In all those years, I’ve never needed to purchase candy to hand out to trick or treaters. On Halloween, my doorbell remained unused.

Even four year old children realize that they can collect more CPS (candy per step) on flat streets with many houses close together than on a steep hill with houses further apart.

But last November we moved to a house on a level street only two blocks south of Ventura Boulevard, a major thoroughfare. This year on Halloween, I’m sure we’ll be hearing the doorbell ring often.

When I was a kid my brother and I loved Halloween. But our mother was a stickler about candy. Even at dinner we had to eat all our salad and vegetables to qualify for dessert. But Halloween candy did not appear to be on her radar. We could gobble down our fill — so long as we did it in our bedroom and not in the kitchen.

I realize now that Mom’s concern about eating sweets was for our benefit. But to this day I check to be sure that vegetables are NOT overcooked (Mom was easily distracted). I’ve also discovered that salad can taste wonderful — when the dressing is more than either lemon juice or just plain vinegar used by Mom. Yuck!

So Daveen — if you’re reading this blog – let’s be sure to buy a bunch of Mars bars (my favorite) at Costco. We don’t want to wake up on November first with TP (toilet paper) dangling from the trees in our front yard.

I may even sample our candy hoard myself.

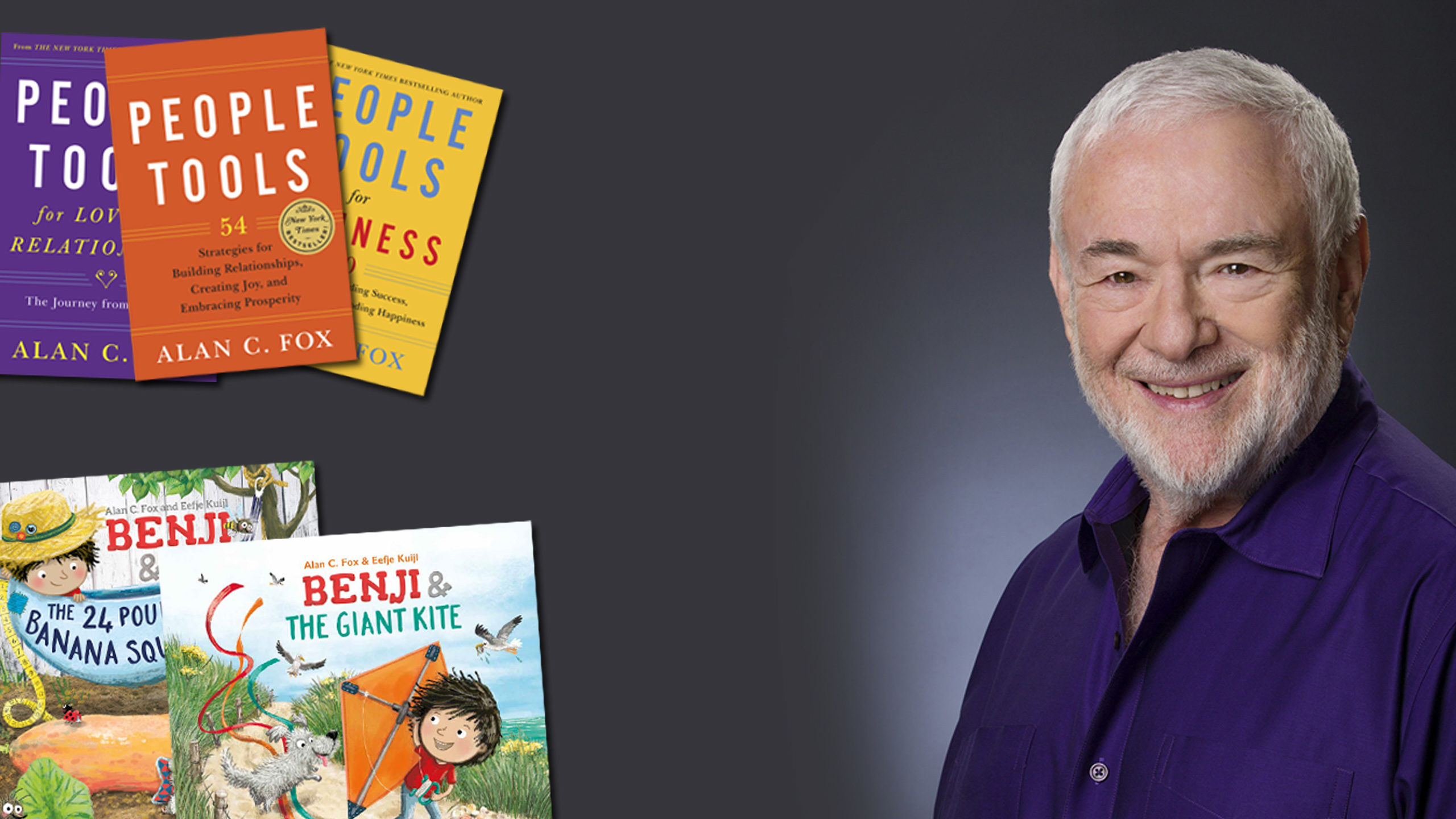

Alan