One recent evening, when she was ready for bed, I started to sing an advertising ditty to Daveen.

Every day’s a special day at Thriftimart

Every day’s a special day just for you

Whatever you put in your shopping cart

You save and save at Thriftimart

‘Cause every day’s a special day

Yes, every day’s a special day

‘Cause every day’s a special day at Thriftimart.

The tune is probably more enjoyable when you hear it being sung. But it makes me wonder how many of us remember the catchy tunes from our youth. For me that was 70 years ago – and I still remember a lot of them.

I know Thrifitmart produced the jingle to attract customers to their stores. Since they are no longer in business this tune lingers in my memory – an artifact from my past, like Frank Sinatra singing, “Fairy tales can come true, it can happen to you, if you’re young at heart…”

We all have special days we remember. Daveen is amazing. She remembers the birthdays and anniversaries of hundreds of people – family, friends, and even acquaintances. Last week she reminded me (four or five times) to wish one of my sons a happy 55th birthday, (I think he was 55).

For me Saturday and Sunday are special days. I don’t have to work, and that means I don’t have to solve problems. All I need to do is decide how I’d like to spend my day, and then do it. This weekend was particularly special. The USC Trojans won their football game and remain undefeated. Next month they will play their archrivals, the UCLA Bruins, who are also undefeated. For me that will certainly be another special day. I might even buy a ticket to the Rose Bowl to enjoy it in person.

When I begin writing a blog I seldom know where it will lead me or how it’s going to end. As someone famous said, “No surprise for the author, no surprise for the reader.” When I started writing this, I didn’t know I would discover something new about myself.

As I contemplate how I spend my days, I realize – every day is special because I’m here. That’s all I need.

Next time we’re together, if you ask me, I’ll sing you the Thriftimart jingle, to remind us both that – yes — Every day is special just for you.

And you and I are special too.

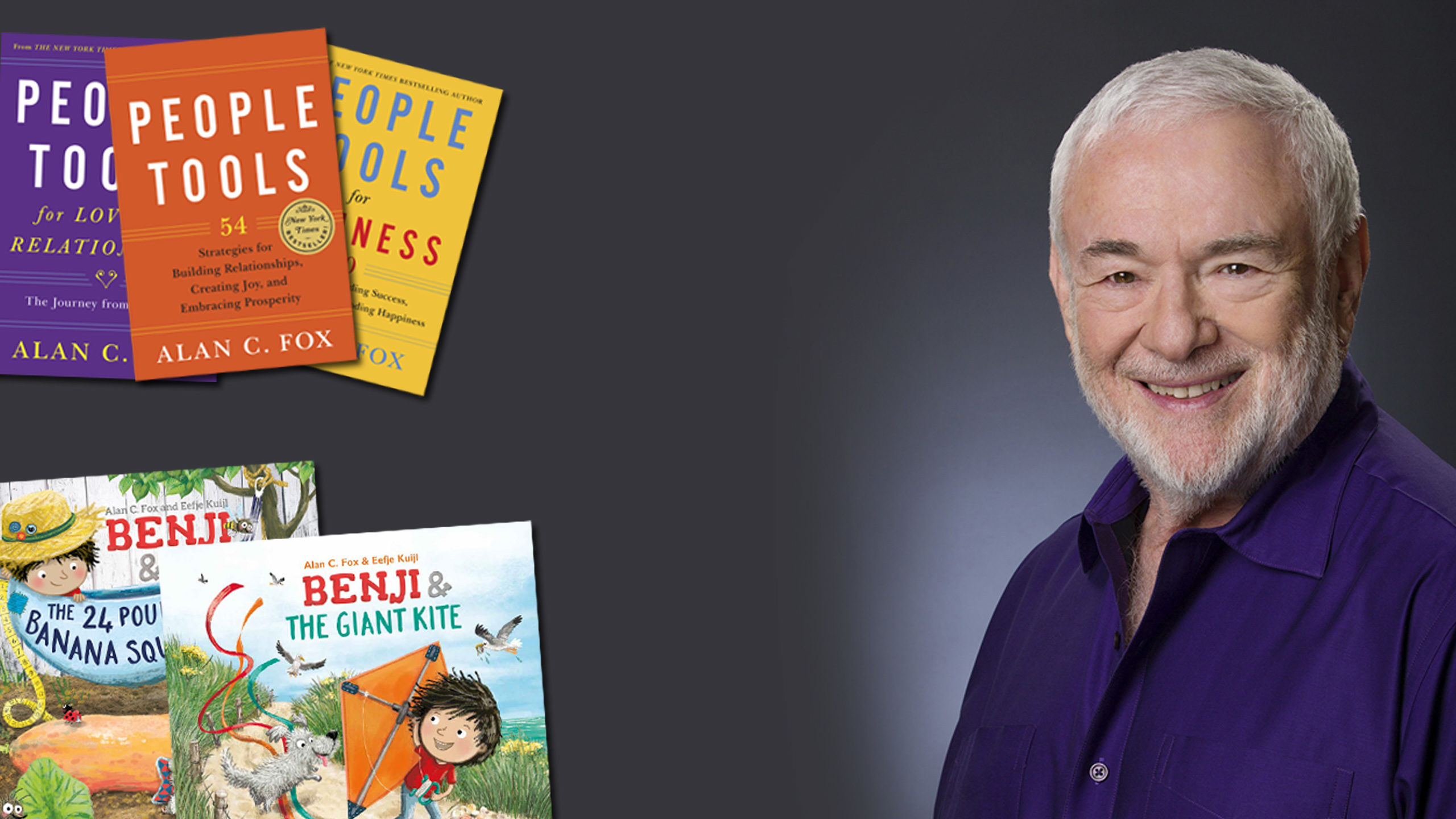

Alan