The last time I was bored was when I ran out of options during my summer break at the age of ten. After all, how many times a week could I visit the Los Angeles Zoo or watch a soap opera on afternoon TV?

A Jules Feiffer cartoon published in the L.A. Times still makes me chuckle. The text is as follows:

“I went to the Laundromat with 12 shorts and 12 pairs of socks. Got back 10 shorts and 8 pairs of socks.

“I went to the Laundromat with 10 shorts and 8 pairs of socks. Got back 9 shorts and 4 pairs of socks.

“I went to the Laundromat with 9 shorts and 4 pairs of socks. Got back 6 shorts, no socks, and a note – ‘Bring me more socks. The Machine.’”

My mind is similar to “The Machine” that devoured the socks – it munches thoughts from the moment I wake up until I fall asleep. I need a constant supply of ideas to keep it busy.

When I opened my law office on April 1, 1967 I realized that I would also need a continuous supply of new cases to keep active — and to earn enough to pay office expenses as well as cover the mortgage payments on my home loan. I’m still a little surprised that my law partner and I never ran out of cash. Some months we came close.

A year later I formed ACF Property Management, Inc. to buy, sell, and manage commercial real estate. That has kept me busy ever since. When I mention that there is at least one minor disaster every single day in property management – I’m not kidding. It keeps me and my employees on our toes.

When I was thirty, I enrolled in afternoon college courses to keep my already busy mind even more occupied as I earned another degree. At that time I wasn’t happy unless I had at least fifteen balls in the air at the same time.

Now (as I reminded Daveen today) I’m no longer 80, and keeping three or four balls in the air simultaneously is more than enough.

Of course, as I write this, I’m also responding to emails and watching football on TV.

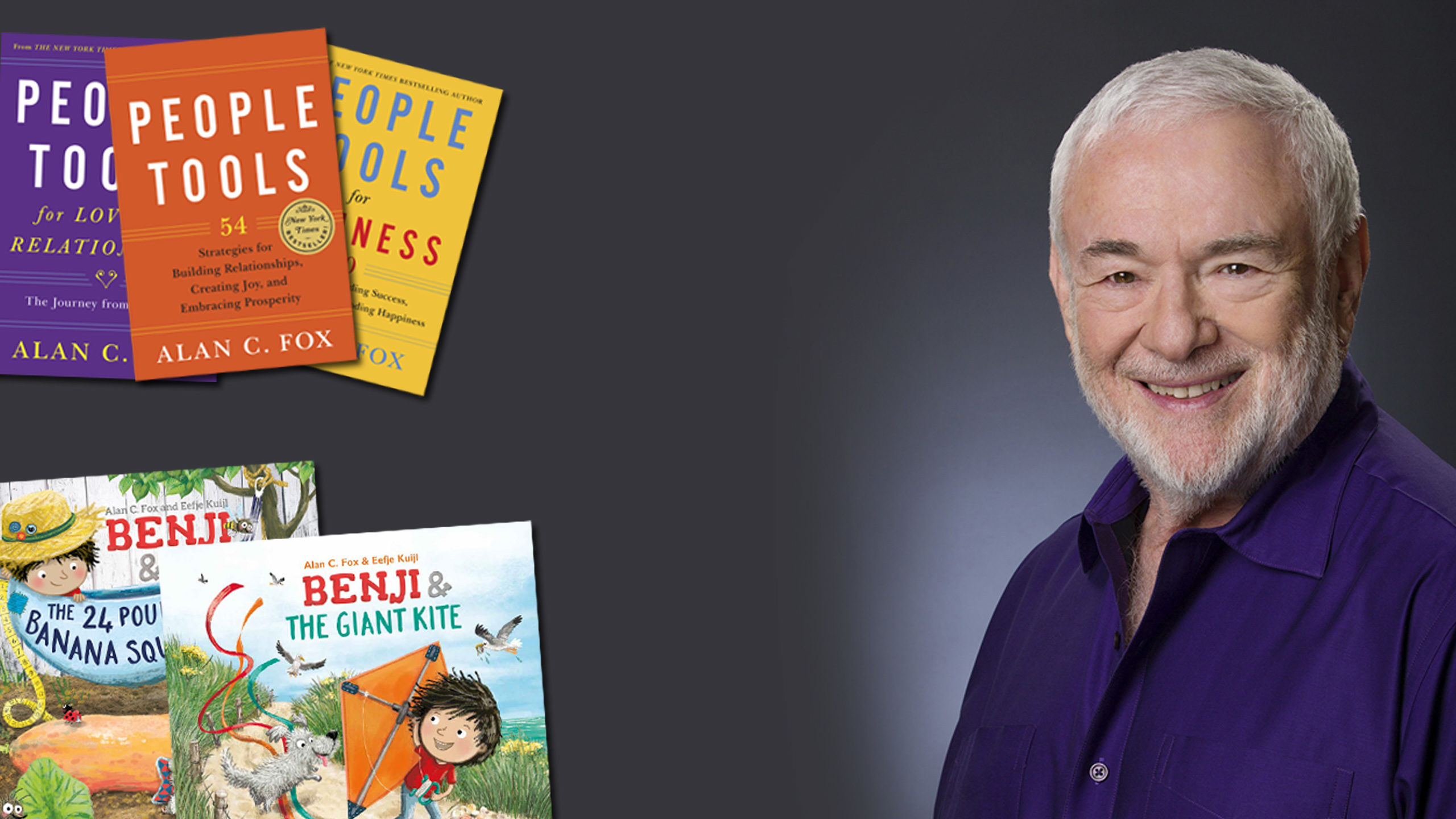

Chapter 7 in my People Tools book is entitled “Patterns Persist.”

My multi-tasking pattern still persists.

Alan “The Juggler” Fox