I hope you have a special oasis in your life or, even better, more than one.

I’m not talking about “a fertile or green area in a desert or wasteland, made so by the presence of water.” What I’m talking about is “a situation or place free from any surrounding unpleasantness. A refuge.”

What is your oasis, your refuge?

One woman told me, “I like to wash the dishes and do the laundry because that’s one area of my life where I’m in control.” That statement surprised me, probably because I would rather shop for groceries than wash the dishes, and I don’t even know how to do the laundry. But it does highlight the fact that every refuge is uniquely personal.

Perhaps surprisingly, I find that sitting at my desk in my office is a reliable oasis – especially in the evening or on the weekend when no one else is there. I love to write, read the news, or watch sporting events on TV.

Another important refuge for me is my bedroom in the evening where I can spend time with my wife or read a book in peace. I also enjoy seeing a well-written and well-acted movie or play.

Visiting with friends and family, especially during the holidays, is something else I really enjoy.

I invite you to think about what your personal oasis looks like. Is there a special time and place? Who is the person or people you need to be with to create your oasis?

Do you highly value “alone” time? A particular part of your workday? Mentoring others? Visiting your grandchildren?

You don’t have to ride a camel over the sand dunes to reach your personal oasis. You just have to know what and who you like, and make it happen.

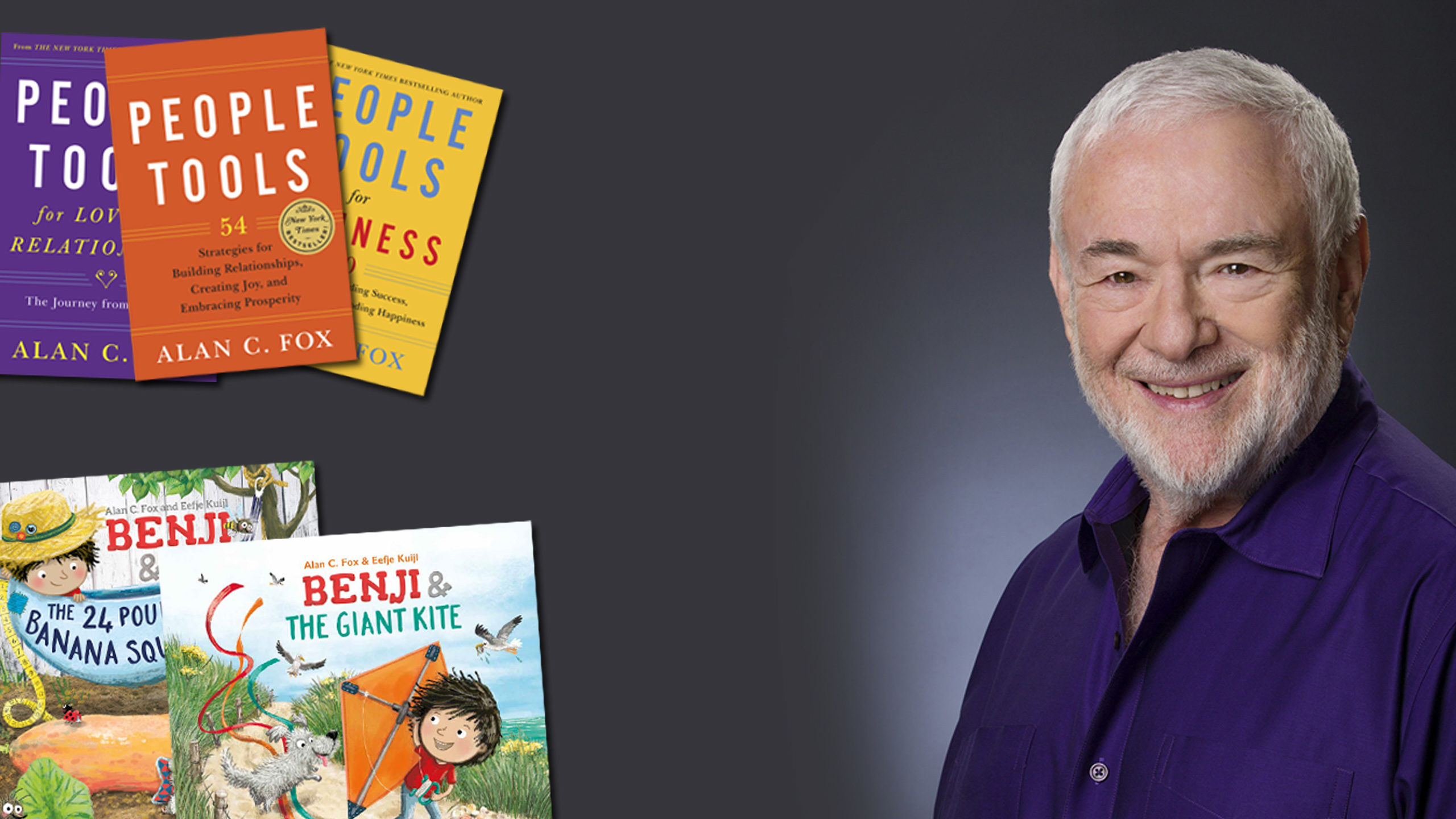

Alan