Playing the Long Game

Years ago I saw a comedy show in Inverness, Scotland. I still remember one of the comedian’s jokes.

Years ago I saw a comedy show in Inverness, Scotland. I still remember one of the comedian’s jokes.

“I’m on a seafood diet,” he said. “I see food, I eat it.”

All too true.

I recently read a study about candy dishes at offices. When the candy was placed on the edge of someone’s desk they ate more than when it was placed twenty feet away.

In my twenties, when I was newly married, a friend asked me why I didn’t often buy my wife a new dress.

“It’s not the cost of the dress that concerns me. I’m bothered by the lost income on the money for the rest of my life. That lost income makes the dress pretty expensive,” I said.

Yesterday my son Craig sent me an article that highlighted how many Americans teeter on the edge of financial ruin. Forty-seven percent of those interviewed said they could not come up with four hundred dollars to meet a sudden emergency. This group included many who earned more than one hundred thousand dollars a year.

What do these examples have in common — Eating food when you see it, spending money when you have it? Both illustrate the natural human impulse to indulge a desire for instant gratification.

When a tribe killed a large animal years ago, the meat couldn’t be preserved, so everyone ate as much as they could. That desire was important for self-preservation. Today binge eating is dangerous. Most everyone has, at times, eaten too much and suffered the consequences later. “Moments on the lips, years on the hips.” At one time in my life I weighed two hundred and seventy eight pounds. I found it difficult to stand up after sitting on the sofa. Many health issues are caused by binge eating. Strike one against instant gratification.

Today we use money to obtain what we need. But our supply of money is limited. If we buy a new car today we may not have enough money for dinner next week. In graduate school I met a teacher, Louise, who was paid at the end of each month. During the three or four days before her next paycheck she often had nothing to eat.

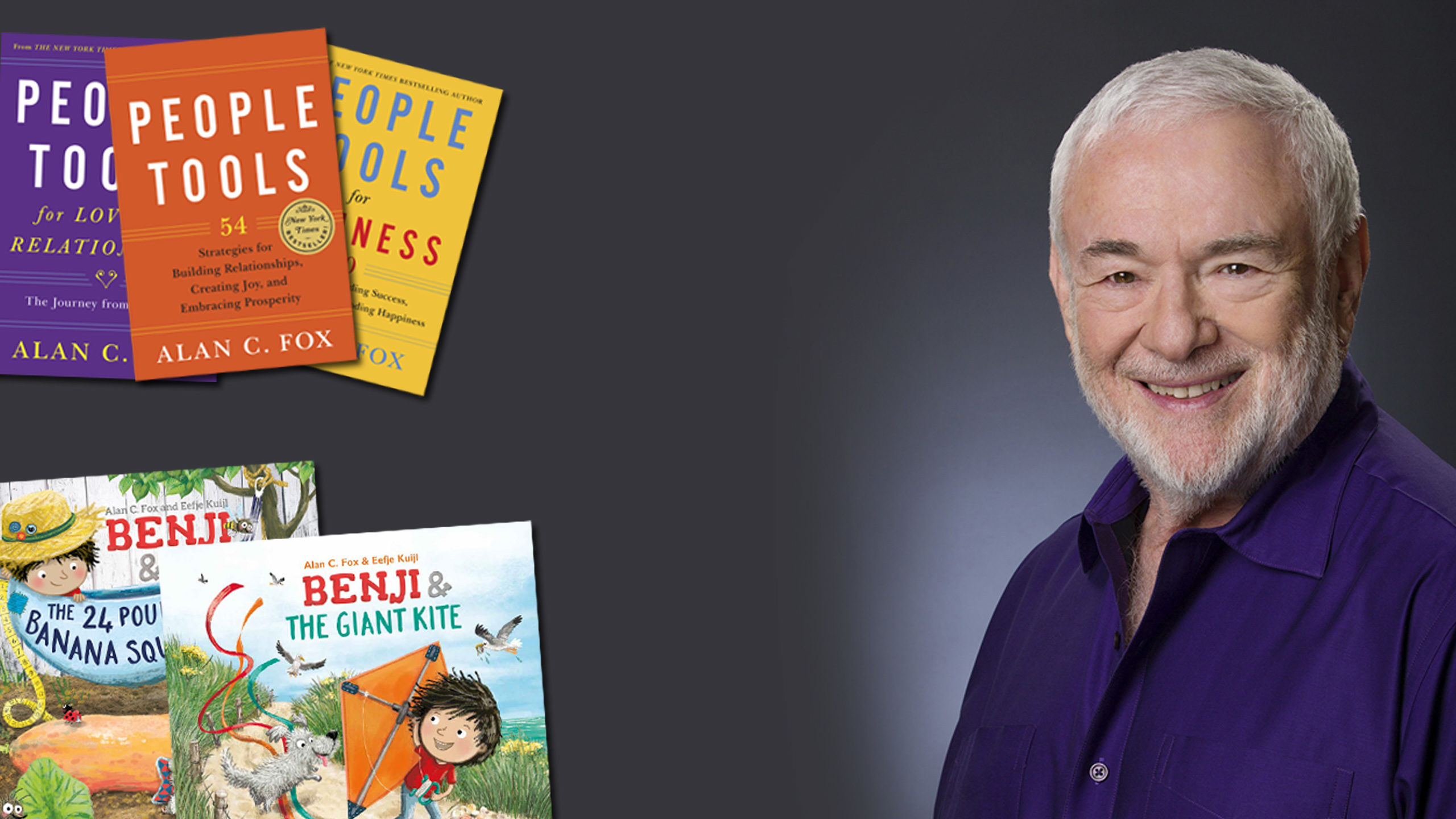

In People Tools for Business, I wrote about a wise professor’s top ten rules for business. The first rule: “Don’t run out of money.” The tenth rule: “Don’t run out of money.” I personally know businessmen and women who spend more than they have on shiny new equipment, unnecessary research, or a large support staff. When they can’t pay the bills everyone suffers – their families, suppliers, and employees. That stress can be a killer. Strike two against instant gratification.

My solution for both problems is this: train yourself to enjoy the process of deferred gratification. Look forward to the quality, not the quantity, of your next meal, and put less food on your plate right now. Half a sandwich for lunch works for me. I can enjoy the second half for dinner. If I don’t see it, I’m less likely to eat it.

With money, make it fun to save. Lorry, a friend at work, used to have jars in which she would put money for a college fund, a vacation, or a new dress. She made a game of saving, and always had enough money to meet her needs.

I know this may take time and may not be easy at first, but it’s fun to teach yourself to play the long game. As Shakespeare wrote, “Small showers last long, but sudden storms are short.”

Alan